Head of state Donald Trump stated he means to enforce tolls on imports from autos, chips and pharmaceutical business, after Head of state Donald Trump stated in a declaration in united state Head of state Donald Trump stated in united state Head of state Donald Trump Donald Trump stated he has a benefit in the Oriental market.

Oriental nations from Japan and India to South Korea and Taiwan export items from all 3 markets to the USA and have actually currently stumbled under enhanced stress Trump’s toll risk

Worries regarding the expropriation of significant Oriental export left-wing capitalists have actually created MSCI’s a lot of considerable index of Asia-Pacific supplies outside Japan to stop by 0.12%.

Likewise on AF: Volkswagen’s $1.4 billion tax obligation costs, international business’ strategies to raise India

Japan’s Nikkei index likewise reduced its early-morning revenues to stop by 0.3% in a day.

The soft efficiency of Oriental supplies remains in raw comparison to over night activity in the S&P 500 and European supplies, both finishing with document highs in spite of climbing worries regarding the international profession battle.

Trump has Claimed prior to The levy on the cars and truck will certainly start on April 2, the day after his closet participants will certainly report to him, describing his choices for different import obligations that look for to improve international profession. The effect of these levies will certainly be really felt throughout Asia.

Japanese cars, chip titans go to danger

Japanese car manufacturers such as Toyota, Honda, Nissan and Mazda are all significant merchants in the USA. Every one of them are currently dealing with possible tolls of 10% of imports to the USA with Mexico.

The danger of greater tax implies car manufacturers are the most significant drag out Japan’s Nikkei index. The automated index dropped by 1.5%.

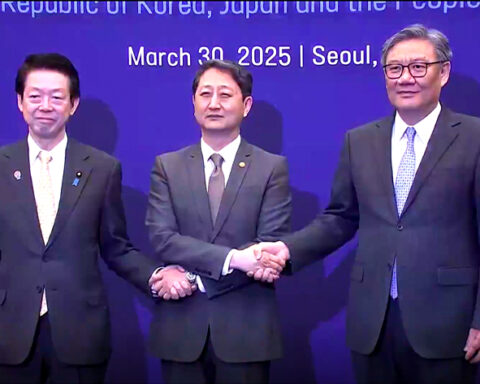

Although the situations of South Oriental car manufacturers such as Hyundai and Kia coincide, the nation’s supply is the only outlier in the area, with a stable rise of 1.7%.

Although the nation likewise deals with the danger of leveraging chip exports, South Oriental supplies have actually obtained supplies at a solid rally.

On The Other Hand, in South Korea’s Oriental chip competing Taiwan, the state of mind was a lot more disappointed, and the results of the marketplace dropped by 0.26%. TSMC, the globe’s biggest agreement chip manufacturer and the heaviest-weighted supply on Taiwan’s heavy index, dropped by almost 1%.

Nonetheless, Experts really hope Tariffs that are not planned to work till April will certainly “some arrangements” in between Taiwan and the USA.

Difficult days for Indian capitalists

In India, the marketplace has actually had a hard time given that the Trump political election triumph and capitalists have actually not obtained much alleviation as car and medication supplies decreased their standards.

The 25% tax obligation price might have struck India’s substantial pharmaceutical sector, with a lot of Indian common producers seeing the USA as their biggest market. For a lot of significant Indian pharmaceutical business, The United States and Canada’s income represent 30% to 50% of the overall

Indian pharmaceutical business’ index made up 2% in 7 months on Wednesday, to its cheapest degree.

The brand-new tax obligation will certainly be an extra injury to India, which has actually dealt with a few of the greatest tolls under Trump’s strategy to enforce common tax obligations.

Worries regarding Trump tolls have actually decreased India’s benchmark index by 13% from its top-level hit price in September.

International Profile Financiers (FPIS) has actually marketed $12.3 billion well worth of Indian shares up until now in 2025, and is seeing a price of almost $16.5 billion throughout 2022. This is the greatest international loss in India in at the very least a years.

- Vishakha Saxena, with Reuters